You’ve likely thought more about your next lambing season or harvest than what happens to the farm in ten or twenty years’ time—and that’s completely understandable.

Farming keeps you busy, and when the work is never done, planning for the future can slip further down the list.

But here’s the truth: every family farm will face a succession moment—planned or not.

Whether you’re years from retirement or starting to think about passing the reins, creating a clear plan now could be the most important investment you ever make. Without one, the business you’ve built—and the legacy you hope to pass on—could face legal hurdles, financial strain, or even division.

This guide is here to help you change that. We’ll walk through the key steps of farm succession planning, highlight common pitfalls to avoid, and show how the right financial tools can smooth the road ahead. Because your farm’s future deserves more than hope—it deserves a plan.

Why Succession Planning for Your Farm Matters

You’ve worked hard to build something lasting—something worth passing on. Your farm isn’t just where you work. It’s where your family has grown, where memories are made, and where generations before you have done the same. That kind of legacy is priceless.

But without a clear plan for what happens next, even the strongest family farms can face uncertainty. We’ve seen it happen: good relationships strained over unclear expectations, land tied up in legal issues, or family members forced into tough decisions because no one wanted to have “the talk.”

You might be putting it off because it feels difficult. Or maybe you’re not sure where to start. That’s completely normal. But the longer it’s left, the more risk there is—financially, legally, and emotionally.

Succession planning isn’t about giving up control. It’s about protecting what you’ve built and giving the next generation the chance to carry it forward—with confidence and clarity. And when you approach it with the right support, it doesn’t have to be as daunting as it sounds.

Common Challenges and Mistakes in Farm Succession

Succession planning can feel like one of the most difficult parts of running a farm—not because you don’t care, but because it’s personal. It involves family, finances, and the future. And it’s easy to see why so many farmers delay it. But knowing the common pitfalls can help you avoid them and plan with confidence.

1. Assumptions Within the Family

Many farmers assume they know who will take over the business—but haven’t had the conversation to confirm it. Maybe your son or daughter has always helped with harvest or managed the books, and it feels obvious they’ll take the reins. But without a clear discussion, assumptions can lead to misunderstandings, especially if multiple children are involved.

What happens if one child expects to inherit the farm, but others expect a share too? These conversations are difficult—but silence only makes them harder down the road.

2. Financial Complexity and Pressure

Even with the best intentions, handing over a farm can get financially complicated. You might want to retire but still need income from the business. Or you may wish to treat your children equally, but the farm can’t be split in a way that feels fair to everyone.

This is where structured finance options can offer flexibility. With the right arrangement, it’s possible to manage lump sums, stage payments, or annual income through tailored repayment plans—helping ease transitions without disrupting operations or cash flow.

3. Leaving It Too Late

It’s human nature to put off tough conversations. You may be waiting for “the right time,” or hoping the path forward becomes clearer on its own. But the longer it’s left, the fewer options you may have.

Delays can mean missed financial opportunities, reduced flexibility in how transitions are handled, and more pressure on both the current and incoming generations. Planning ahead can open the door to funding structures that ease this pressure—giving time to build sustainable change.

4. Lack of Fit-for-Purpose Finance

Many rural businesses experience irregular cash flow—driven by seasonal peaks, grant timing, or livestock sales. If a succession plan relies on rigid or unsuitable finance, it can create further stress.

Instead, structured finance that aligns with the business cycle—monthly, seasonal, or grant-timed bullet payments—can help keep everything running smoothly while major changes are underway. The right funding model can make the difference between a stressful handover and a confident, steady transition.

Creating a Smooth Transition Plan

You’ve put years—maybe decades—into building your farm. Planning how to hand it over isn’t about stepping back overnight. It’s about shaping a future that works for your family, your business, and your peace of mind.

A good farm succession plan doesn’t just tick legal boxes—it reflects your values, your wishes, and the needs of the next generation.

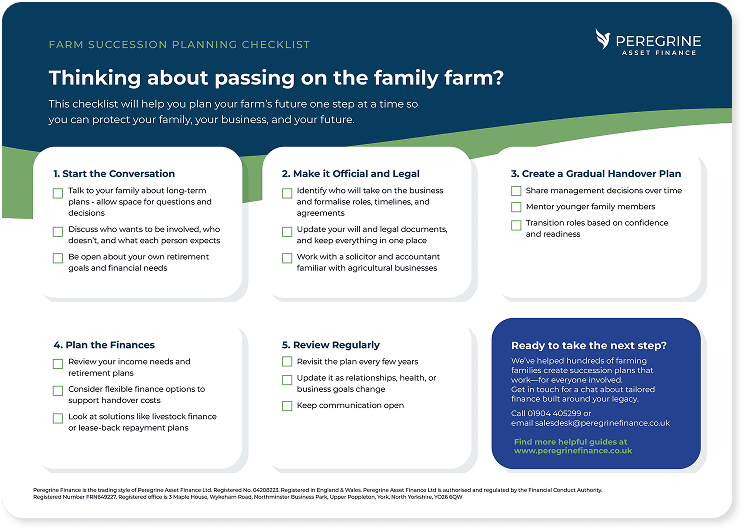

Here’s how to make the process smoother, step by step:

1. Start the Conversation Early

Succession planning isn’t a one-off chat. It’s a series of conversations over time—about roles, responsibilities, expectations, and goals. Start talking with your family now, even if you’re years from retiring.

Early conversations mean:

- Everyone has time to consider their future

- There’s room to adjust the plan as circumstances change

- Emotions can be handled gradually, not under pressure

You don’t need all the answers on day one. Just start talking.

2. Clarify Who Wants What

Every family is different. Some children are actively involved in the farm. Others have chosen different paths. And while fairness matters, “equal” doesn’t always mean “identical.”

It helps to ask:

- Who wants to run the farm?

- Who expects an inheritance or financial return?

- What are your own retirement goals and income needs?

Being open and realistic helps avoid conflict and confusion later on.

3. Make It Official

Once you’ve had the conversations, formalise the plan. This might include:

- Updating your will

- Creating a partnership agreement or family business structure

- Outlining who owns what and when ownership will transfer

- Setting up insurance or finance solutions to support the plan

Speak to a solicitor or accountant who understands agricultural businesses. Getting this right legally is key to protecting your assets and minimising tax issues.

4. Plan for a Gradual Handover

You don’t have to hand over the keys and walk away. Many farmers prefer a phased approach—slowly shifting responsibilities while mentoring the next generation.

A gradual handover can include:

- Shared management over a defined period

- Introducing younger family members to business decisions

- Updating roles as confidence and skills grow

This eases the transition for everyone involved—and gives you the chance to step back on your own terms.

5. Review and Adjust Over Time

Your plan isn’t set in stone. Life changes—health, relationships, finances. Revisit your succession plan every few years to make sure it still fits your situation and goals.

A smooth succession isn’t about control or letting go. It’s about ensuring your farm, your values, and your life’s work carry on—with clarity, respect, and support. When you lead the conversation, you give your family the gift of certainty and confidence for the years ahead.

How Can Finance for Your Farm Make the Transition Smoother?

Passing on the farm often brings up a big question: how do we make it work financially? Whether you’re looking to retire comfortably, buy out family members fairly, or invest in the next phase of the business, having the right finance in place can make all the difference.

We believe finance shouldn’t be a barrier to succession—it should be part of the solution.

1. Supporting Business Growth for the Next Generation

Handing over the business doesn’t mean leaving it as-is. Often, the next generation brings fresh ideas—diversification, new equipment, or even a shift into areas like renewable energy.

With tailored agricultural finance, you can help them:

- Invest in modern machinery or infrastructure

- Expand operations or add new revenue streams

- Upgrade outdated equipment before handing over the reins

This not only sets them up for success—it strengthens the long-term future of the business.

2. Managing Retirement Income

Many farmers worry about how they’ll support themselves once they’re no longer running the business day-to-day. With the right financial structure, you can plan for a steady income in retirement while still keeping the farm in the family.

Options might include:

- Lease-back arrangements

- Structured finance repayments from the new owners

- Refinancing a new farm project

Talk to an asset finance provider to better understand your options.

4. Tailored Finance, Built Around Your Farm

Every farm is different, and so is every succession plan. At Peregrine, we don’t believe in one-size-fits-all finance. Our approach is flexible, personal, and grounded in real-world farming experience.

We offer solutions across:

- Agricultural machinery finance

- Livestock finance

- Refinancing

- Renewable and diversification project funding

These tools aren’t just for growth—they’re for continuity. They help smooth the transition between generations and protect what matters most.

Succession planning is about more than handing over land or buildings—it’s about giving the next generation a strong, stable start. And with the right financial tools in place, you can do that without jeopardising your own security or the farm’s future.

Next Steps

If you’ve made it this far, you’re already doing something many put off—you’re thinking seriously about the future of your farm. That’s no small thing. Succession planning isn’t quick or easy, but it is one of the most important things you’ll ever do for your family and your business.

You have options available and don’t have to figure it out on your own. At Peregrine, we specialise in working with generational farming families just like yours, offering clear, practical finance support tailored to rural businesses.

Where to Start

If you’re unsure where to begin, here are a few first steps:

- Talk to your family – Open up the conversation. Ask questions. Listen.

- Get your paperwork in order – Wills, partnership agreements, land ownership—all of it matters.

- Explore finance options – Understand what’s possible with agricultural finance, asset finance to business investment.

- Speak to an expert – A conversation with someone who understands farming and finance can clarify your next move.

Let’s Secure Your Legacy—Together

At Peregrine, we understand that your farm is more than a business. It’s a part of your identity, your family, and your history. Our role is to support you in protecting that legacy—so it can continue to grow in the hands of the next generation.

Whether you’re ready to make a move, or just starting to think things through, we’re here to help you find flexible finance. Get in touch today